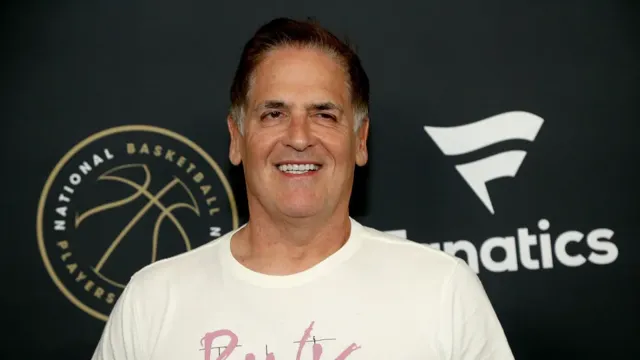

American businessman Mark Cuban has a lot to say about money in the business world. As a self-made billionaire, he has become a renowned entrepreneur and investor known for his straightforward financial advice. You might have seen him investing in future entrepreneurs on the show Shark Tank. We’ve brought you six Mark Cuban money lessons that are sure to help you succeed.

1. Live Below Your Means

In other words, you need to spend less than you earn. If you spend it all, you won't be building wealth. Avoid living paycheck to paycheck and don't rack up a lot of debt - people with the most success and who achieve financial success live within their means.

2. Pay Off Credit Cards Each Month

If you can’t pay off your credit cards each month then don’t use them. Mark Cuban's advice is to use cash or a debit card instead to avoid incurring credit card debt. Recognize that if you’re paying a credit card up to 30 percent in interest, it’s costing you more.

3. Don’t Quit Your Job Without a Plan

Mark Cuban's philosophy says, “Before you quit, be prepared, know what you’re doing, save your money, and have at least six months to live off if you can. And then maybe you’re ready to start your own business.”

4. Limit Risky Investments to 10%

No more than ten percent of your portfolio should be in high-risk assets according to Mark Cuban. Diversification can protect your overall investment, as it lessens the impact of potential losses from any one investment. Cuban lives by these words every day as evident on Shark Tank where he's helped turned entrepreneurs and ideas into several successful companies.

5. Weigh Your Options with Affordable Colleges

Cuban says the name of the college doesn't matter as much as the value you receive for the price you pay. He says, "A community college that offers transferable credits is always smart. There isn’t a lot of value in big-name schools for freshman or sophomore classes”.

6. Save Six Months of Income

Cuban advocates the need for an emergency fund that is large enough to cover six months of living expenses. This way, you won't have to rely on credit or high-interest loans if you have a job loss or illness and you have more money to help out with unexpected job loss or other high priority needs.

Conclusion

Mark Cuban had humble beginnings but ended up achieving remarkable success, becoming one of the wealthiest people in the world. As the owner of the Dallas Mavericks, he significantly improved the team's performance, leading them to their first NBA championship in 2011. Additionally, Cuban is a serial entrepreneur who leverages his infinite curiosity and emotional intelligence to create multiple successful ventures over time. His sage advice on money management can help you.