- Quick Summary

- Introduction

- What Is an Expense Tracker App?

- Benefits of Using an Expense Tracker App

- YNAB: Expense Tracker App

- Expensify: Personal and Business Expenses

- EveryDollar: Budgeting App

- Rocket Money: Plan for Financial Health

- AndroMoney: Manage Your Wealth

- Money Manager & Expenses

- 1Money

- Goodbudget

- Conclusion

- Quick Summary

- Introduction

- What Is an Expense Tracker App?

- Benefits of Using an Expense Tracker App

- YNAB: Expense Tracker App

- Expensify: Personal and Business Expenses

- EveryDollar: Budgeting App

- Rocket Money: Plan for Financial Health

- AndroMoney: Manage Your Wealth

- Money Manager & Expenses

- 1Money

- Goodbudget

- Conclusion

An integral part of creating a budget is knowing your expenses. Even after you know them, it’s essential to keep track of them in case new ones occur. Budgeting apps and expense tracking apps can help you manage your finances more efficiently. But you can’t carry paper around, writing them down. Syncing your financial accounts with these apps saves time and keeps your financial information accurate. That’s where apps come into play. Here are eight apps for tracking your expenses.

Introduction

In today’s digital age, managing personal and business finances has become easier than ever, thanks to the numerous expense tracker apps available. These apps help individuals and businesses track their expenses, stay on top of their financial health, and make informed decisions about their money. With so many options available, it can be overwhelming to choose the right expense tracker app for your needs. In this article, we will explore the benefits of using an expense tracker app, what to look for when choosing an app, and provide an overview of the best expense tracker apps available.

What Is an Expense Tracker App?

An expense tracker app is a digital tool designed to help individuals and businesses manage their finances by tracking expenses, income, and cash flow. These apps allow users to record and categorize their expenses, set budgets, and generate reports to help them understand their financial situation. Expense tracker apps can be used for both personal and business expenses, and many apps offer features such as automatic expense tracking, receipt scanning, and integration with bank accounts and financial software.

Benefits of Using an Expense Tracker App

Using an expense tracker app can have numerous benefits for individuals and businesses. Some of the key benefits include:

-

Improved Financial Health: By tracking expenses and income, individuals and businesses can gain a better understanding of their financial situation and make informed decisions about their money.

-

Increased Productivity: Expense tracker apps can automate many tasks, such as data entry and report generation, freeing up time for more important tasks.

-

Enhanced Budgeting: Expense tracker apps can help individuals and businesses create and stick to a budget, reducing the risk of overspending and financial stress.

-

Better Cash Flow Management: By tracking expenses and income, individuals and businesses can better manage their cash flow, reducing the risk of late payments and financial penalties.

-

Tax Benefits: Expense tracker apps can help individuals and businesses keep track of deductible expenses, reducing the risk of missed tax deductions and penalties.

Overall, expense tracker apps can be a valuable tool for anyone looking to improve their financial health and management. By choosing the right app for your needs, you can take control of your finances and achieve your financial goals.

YNAB: Expense Tracker App

YNAB is one of the leading budgeting apps that uses the zero-based budgeting method to help you control money. It requires you to account for every dollar of income by allocating it to a category such as bills, investments or savings. The goal is to set aside money for specific expenses before spending it. The cost is $14.99 monthly or $99 annually. It’s available on iOS.

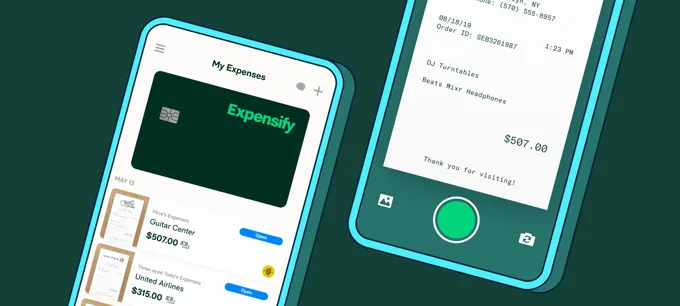

Expensify: Personal and Business Expenses

Expensify is an expense tracking app that combines personal and business expenses. It automates expense management and receipt tracking. It streamlines your pre-accounting process and syncs with QuickBooks and Xero. It only has one-click expense reports that operate in real time. The cost is $36 monthly, and it’s aimed at businesses with one to ten employees or up to 1,000. It’s available on iOS.

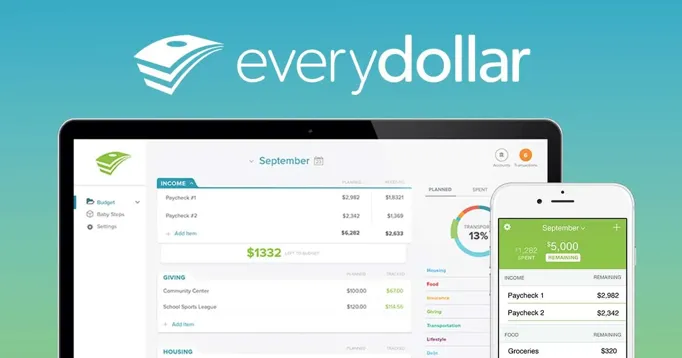

EveryDollar: Budgeting App

Dave Ramsey created EveryDollar, a personal budgeting app that helps users manage money. This app uses a zero-based budgeting approach. You assign each dollar you earn to a category for the month. You must ensure that your income minus expenses equals zero. EveryDollar helps you track expenses, plan spending, set goals, and stay on top of personal finances. It has a basic free or premium version for $17.99 monthly or $79.99 annually. It’s available on iOS.

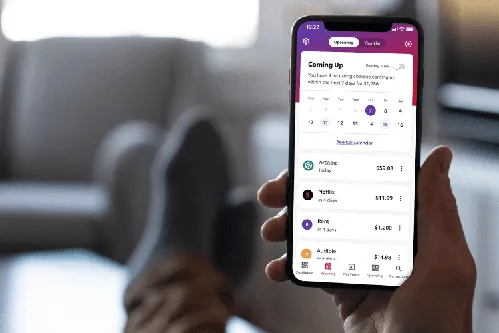

Rocket Money: Plan for Financial Health

Rocket Money helps you track expenses. But it has an interesting twist, it finds and cancels your unused subscriptions. It also emphasizes the importance of securing financial data to ensure better financial insights and enhanced security protocols. It claims it can lower some charges on recurring bills. The app has a paid and free version. Features including bill negotiation service have an additional fee. The premium version is a sliding scale between four dollars and $12. It’s available on iOS.

AndroMoney: Manage Your Wealth

AndroMoney is a versatile app that tracks daily budgets, manages budgets and manages multiple accounts. It offers alerts when you’ve exceeded your budget and real-time expense reports. There is an ad free version or a premium version for $3.99. It’s available on Android.

Money Manager & Expenses

Money Manager & Expenses helps you track your income, expenses and budget to monitor your finances. It helps you understand your spending habits and identifies areas for improvement. This is a free app, so there are some ads. It’s available on Android. Additionally, the app offers a free trial period, allowing users to test its features before committing to a subscription.

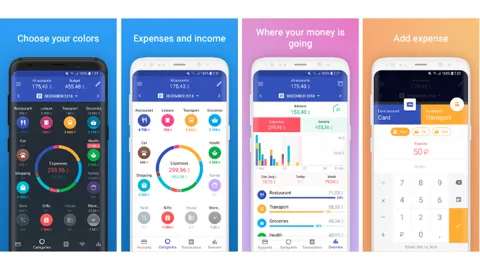

1Money

1Money adds a new transaction with a single tap. You just enter the amount. It helps you plan income and expenses to help you avoid accidental or impulse purchases. The app also offers features similar to Empower (formerly Personal Capital), such as free financial dashboards, investment analysis, and personalized financial advice. It automatically updates currency exchange rates. Helpful if you’re traveling. It also syncs with all your devices. It has easy navigation and is simple. It has a free or premium version for $1.99 monthly or $24.00 annually. It also has a lifetime premium package for $9.99. It’s available on Android and iOS.

Goodbudget

Goodbudget is a good beginner expense tracking app. It allows couples to budge and track expenses. It uses the envelope method to categorize money into digital envelopes based on needs and wants. You can create your own envelope or use the pre-labeled ones. Each month, you allocate a set amount of income into each envelope and spend it based on the categories. But it doesn’t sync to your bank account; you’ll have to manually enter your transactions. It’s free. Goodbudget is available on Android and iOS.

Conclusion

It’s always helpful to have a watchdog when trying to stay within a budget. An expense app can do that for you by effectively managing your personal finances. It makes you aware of every dime you’re spending and keeps you within budget.