Artificial intelligence (AI) is used in many industries. From AI-powered medical diagnostics to customer service chatbots, it’s had a big impact. But AI is also making waves in personal finance. Managing your money is more important than ever. And AI can help you do just that.

Introduction

In today’s fast-paced world, managing finances effectively is crucial for individuals and businesses alike. With the rise of artificial intelligence (AI), budgeting has become more efficient, personalized, and accessible. AI budgeting tools have revolutionized the way we manage our finances, providing real-time insights, automating tasks, and enhancing financial decision-making. These tools not only simplify the budgeting process but also offer tailored recommendations to help you achieve your financial goals. In this article, we will explore the world of AI budgeting, its benefits, and how it works.

What is AI Budgeting and How Does it Work?

Definition of AI Budgeting

AI budgeting refers to the use of artificial intelligence and machine learning algorithms to analyze financial data, automate budgeting tasks, and provide personalized financial insights. These advanced budgeting tools leverage natural language processing (NLP) and predictive analytics to understand your financial patterns, identify areas for improvement, and offer tailored recommendations. By analyzing vast amounts of financial data, AI budgeting tools can help you make informed financial decisions and optimize your financial health.

How AI Budgeting Tools Automate Financial Data

AI budgeting tools automate financial data by seamlessly connecting to your bank accounts, credit cards, and other financial institutions. Using sophisticated machine learning algorithms, these tools categorize transactions, track expenses, and identify spending trends. This automation eliminates the need for manual data entry and tracking, allowing you to focus on high-level financial planning and decision-making. By continuously analyzing your financial data, AI budgeting tools provide real-time insights and help you stay on top of your finances.

Benefits of Using AI in Budgeting

The benefits of using AI in budgeting are numerous and impactful. AI budgeting tools provide:

- Real-time financial insights and reporting: Stay updated with your financial status at any moment.

- Automated budgeting and expense tracking: Save time and reduce errors with automated processes.

- Personalized financial recommendations: Receive tailored advice based on your unique financial situation.

- Enhanced financial decision-making: Make more informed financial decisions with data-driven insights.

- Improved financial planning and forecasting: Plan for the future with accurate predictions and analyses.

- Increased efficiency and productivity: Focus on strategic financial management rather than mundane tasks.

By leveraging AI in budgeting, individuals and businesses can make informed financial decisions, optimize their financial performance, and achieve their financial goals. Here are the five top AI tools to automate your budgeting in 2024.

1. Cleo

Cleo is an AI tool and budgeting app. It tracks how much you’re spending and saving. It has a tool that gives you tips customized to how much money you could save daily, weekly, or monthly. The app shows how much the money will grow over time. It also has a feature called “Roast Mode”. It will jokingly make jokes about your spending to help you stay on track. Cleo monitors your bank account balance and notifies you when you are low. The app also prompts you to pay your bills on time. The basic app is free, but Cleo Plus is $5.99, and Cleo Builder is $14.99 per month.

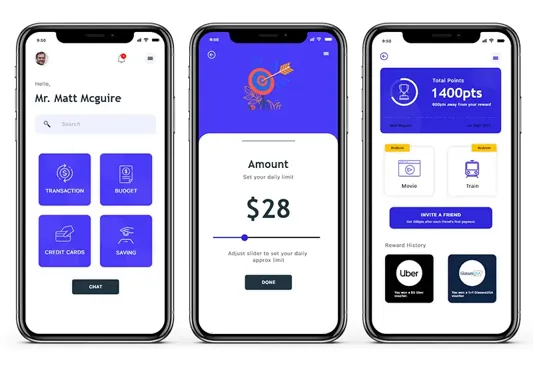

2. Buddy

Buddy is an AI budgeting tool that helps you manage your finances and track budgets. It helps you to stop overspending. You can use Buddy without linking it to your bank accounts. The downside is that you must manually enter your information. But you can upload an Excel sheet to Buddy. The app is considered user-friendly. You can invite your partner on the app with the shared budget feature. Buddy is customizable so you can create your own categories. There’s a free version and a premium for $4.99 per month.

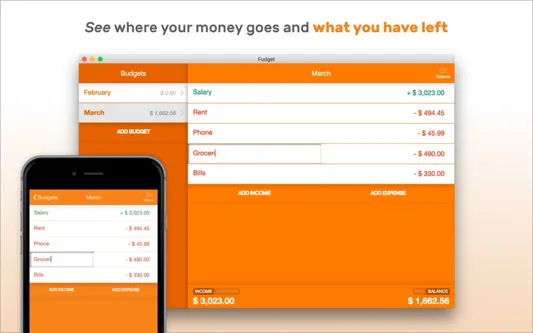

3. Fudget

Fudget is known for its simplicity and efficiency in managing personal finances. It’s designed to be user-friendly and it also provides a clean and straightforward interface. It supports synchronization across iOS, Android, Mac and Windows platforms. The paid version includes unlimited budgets and entries. It also has real-time budgeting across multiple devices. It lets you start entries that can be repeated monthly. Your budget can be created and exported. It comes with a free version and a paid that’s $19.99 annually. Fudget is an excellent choice for personal finance management due to its simplicity and efficiency.

4. Goodbudget

Goodbudget is one of the best free budgeting tools. It uses the envelope budgeting method. This is where you divide your money into different spending areas and keep track of your expenses. It has good connections to banks, which makes the transactions easier to manage. Goodbudget instantly updates and syncs transactions across all devices. That way, you can track your budget from anywhere. It also provides graphs that help you understand your money habits. Goodbudget is free with $8 monthly for premium features. Goodbudget’s envelope method is a modern take on traditional budgeting methods, making it easier to manage your finances.

5. Wizely

Wizely lets you set monthly budgets to track spending and save money effectively. But what sets this app apart is Wizely Wednesdays. It offers the user the chance to earn cash rewards. All you have to do is complete financial tasks and improve your Financial Wellness Score. Wizely encourages financial management by fostering engagement. It also creates flexible savings plans for emergencies, large purchasers, etc. Wizely provides an autosaving option on a weekly, monthly or yearly basis. Wizely’s features are so advanced that they rival the advice you would get from professional financial advisors.

Conclusion

Creating and sticking to a budget is imperative to achieve your personal finance goals. But sometimes you need some help. These AI tools can help you not only budget but also save. These AI tools are not only beneficial for individuals but also for finance teams looking to streamline their budgeting processes.