A credit card can be a convenient item in your financial arsenal. But if you start using it the wrong way or even abusing your credit, you can end up in debt. We’re here to keep you from doing that. Here are ten times you shouldn’t use your credit card for payment.

1. Mortgage or Rent

Don’t pay your mortgage with a credit card because you’ll pay interest with interest. You’re mortgage probably has a single-digit interest rate. Using a credit card for mortgage or rent can quickly max out your credit limit, leading to higher interest costs. Your credit card can be more than 20 percent. You’re financing a low-interest loan with a high-interest loan. This can also complicate debt payments and increase financial strain. Also, with both a mortgage and rent, you’ll have payment processing fees that the landlord or lender will probably have you pay. These are often three percent of the payment. This payment will be more than any awards you would have earned.

2. Income Taxes

The IRS assesses a 1.85 to 1.98 percent processing fee for using a credit card. It is important to manage credit card payments effectively to avoid excessive debt when paying income taxes. If you have a big tax bill, that processing fee will eat up your reward points if you don’t pay the balance off immediately. However, if you plan on paying the balance off quickly and you have cash back of two percent on every purchase, it might be worth it.

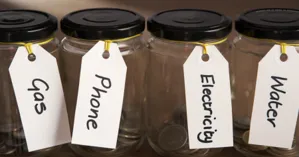

3. Utilities

Since you know this is a monthly charge, make automatic utility payments directly from your bank. Using credit cards for everyday purchases like utilities can lead to accumulating debt if not managed properly. Utilities also have a processing fee. If you constantly pay with your credit card and don’t pay the balance off immediately, you’ll be in debt that keeps growing monthly.

4. Cash Advances Withdrawals

Cash advances from a credit card can be a quick and easy way to get cash to cover bills. But this can also be a dangerous proposition. It could wreak havoc on your finances. Cash in advances have hefty fees. Cash advances often have a higher APR than regular purchases. And there isn’t time to pay it off before you’re charged. Interest starts accruing immediately.

5. Online Betting

Online betting has become more and more popular. But it shouldn’t be popular to use a credit card. Using a credit card for online betting can quickly max out your credit limit, leading to higher financial risk. Some credit card issuers won’t give you the option to use your credit card. Depending on where you live, there may also be some limitations. But if you can use a credit card, it’s risky. You’re basically paying high interest to bet. Most credit card companies will consider this a cash in advance, so you’ll have the fees and high interest to contend with. It might wipe out any winnings you have.

6. Tuition

Although some colleges accept credit cards, the added processing fees might make using the card a bad idea. Setting up a payment plan with the college can help manage tuition payments more effectively, easing the financial burden. Plus, you’re paying double-digit interest rates. A student loan has a much lower interest rate, and you’re not under the gun to pay it back immediately.

7. Peer-to-Peer Payments

Peer-to-peer (P2P) payment platforms like Venmo or Cash App permit you to connect your credit card to the account. Then you can send money to businesses or other people. Frequent peer-to-peer payments can complicate debt payments and increase financial strain. But the problem is that you may be charged a three percent fee for each transaction. Using it several times a day or week adds up quickly. But the worst part is some credit cards treat P2P as cash in advance transactions. That means you’ll have credit card fees and additional interest.

8. Applying for a Loan

If you’re going for a large loan, like a mortgage, stop using your credit cards. Managing credit card payments effectively is crucial to maintain a favorable debt-to-income ratio when applying for a loan. Lenders review your credit report; a high credit card balance is a red flag. It could increase your debt-to-income (DTI) ratio. This will reduce the amount of money you qualify for to borrow money. It also could increase your credit utilization ratio. That means you’ve used too much of your credit. Lenders look at all of these. Just don’t use the cards.

9. Credit Card Balances

You should be able to pay off your balance every month. Utilizing balance transfers can help manage credit card debt by consolidating multiple debts into a single low-interest monthly payment, often with promotional 0% APR periods that reduce interest charges. If you can’t, you’ll be charged high interest. If you can’t pay it off, then don’t continue to drive the balance up further by using your credit cards. Put them away and only use your debit card.

10. Chasing Rewards Points

Don’t be tempted to use your credit card to earn rewards. The strategic use of a rewards credit card can be beneficial if used wisely, such as balancing APR and potential rewards earned on purchases. If you’re thinking about making a purchase solely on getting those points, refrain. All you’ll do is rack up your credit card balance. Then, the interest will eat the rewards’ value away if you don’t pay off the balance monthly.

11. Impulse Buys

Using a credit card when you’re in a heightened emotional state can lead to impulsive purchases and poor financial decisions. It’s essential to take a step back, breathe, and assess your spending habits before making any purchases. Consider implementing a 30-day waiting period for non-essential purchases to ensure you’re making rational decisions. Additionally, consider using a budgeting app or spreadsheet to track your expenses and stay on top of your finances. This way, you can avoid the trap of emotional spending and keep your credit card balance in check.

12. Credit Report Changes

Ignoring your credit report can lead to missed opportunities to improve your credit score and potentially costly errors. Check your credit report regularly to ensure it’s accurate and up-to-date. Dispute any errors or inaccuracies with the credit bureaus and work to resolve any outstanding issues. Consider using a credit monitoring service to receive regular updates and alerts about changes to your credit report. By staying on top of your credit report, you can maintain good credit habits and avoid common credit card mistakes that could harm your financial health.

13. Dealing with Identity Theft

If you’re suspicious of fraud, it’s crucial to take immediate action to protect your credit card information. Contact your credit card issuer to report any suspicious activity and request a replacement card. Monitor your credit report closely for any unauthorized transactions or changes. Consider using a credit monitoring service to receive alerts and notifications about any changes to your credit report. Remember to always verify the authenticity of any emails or phone calls claiming to be from your credit card issuer. Taking these steps can help safeguard your finances and prevent potential credit card fraud.

Conclusion

Using a credit card for the wrong things can spiral your finances out of control. Think twice before pulling out that card. Consider what it's going to cost you.