Whether you want to take advantage of credit card rewards or build your credit, not everything should be put on a credit card. There are some expenses you should avoid when swiping your card. Here are ten things you should never, ever put on credit.

1. Cash Advances

When you take a cash advance, you borrow against your credit card. Cash advances come with a high cash advance APR, often exceeding 25%, and interest starts accruing immediately. In other words, you’re borrowing from yourself. And you’re paying the amount back with high interest rates. Most credit cards have fees that they tack onto cash in advance. It’s not worth the extra money you’ll spend shelling out for that advance. As a piece of advice, if the money is not available in your bank account or through some other means, it's not wise to go against your credit card for additional money.

2. Mortgage Payments

Most lenders won't let you use a credit card to pay your mortgage. But there are third-party vendors like Melio who can help you do this. But they charge a fee. You'll also have a high interest on your credit card that will need to be paid. Most mortgage rates hover around three to six percent. While credit cards are around 20 to 30 percent. Do the math to determine which is the better deal. Also, if you choose to go this route, ensure your credit limit can handle the mortgage payment, among your other expenses, since sometimes those can be hefty amounts.

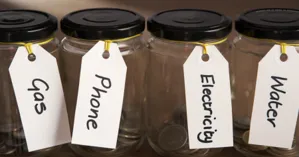

3. Utilities

Paying household bills, such as utilities, with a credit card can lead to overspending and accumulating debt. You could link your credit card to the utility company and set it up for automatic payments to pay bills. But this isn’t always a good idea. It’s basically an out of sight out of mind scenario. You then have to remember to pay it off every month. If you don’t, ongoing charges add up to a big payment. Remember that high interest rate. Your utilities could end up costing you more than they should.

4. Medical Bills

Never put your medical bills on a credit card. Medical debt can accumulate high interest if put on a credit card; instead, consider negotiating bills or utilizing payment plans. Pay what you can with a debit or check. Medical bills can be hefty, and you only dig a deeper financial hole for yourself when you put those bills on a high-interest credit card. Instead, contact the hospital or healthcare provider and set up a payment plan.

5. Taxes

Paying taxes with credit card payments is legal, but that doesn’t mean it’s a good idea. Your payment processor charges around a two percent fee for using a credit card, and that can add up fast. The IRS also has payment processing fees. For a credit card, it’s 1.8 percent. If you owe thousands of dollars, this could be an expensive fee. In contrast, the IRS only charges a $2.50 flat fee if you use a debit card, regardless of how much you owe. Your property tax usually has a two to three-percent convenience fee when you choose to use your personal credit card for payment, so avoid using a credit card for them as well.

6. Down Payments

If you need to use your credit card to make a down payment, you can't afford it. Adding a high interest rate to the down payment's cost will make a challenging situation worse.

7. Vehicles

Unless you're confident you can pay off your car when the bill arrives, putting a car on your credit card doesn't make sense. It doesn't matter how many points you receive. You'll be trading a six percent interest rate for a 30 percent interest rate. This will delete the worth of any points you receive. A better way to pay your car payment is through your checking account to ensure it gets paid monthly and you're not impacting your credit.

8. College Tuition

Resist the urge to pay your college tuition with a credit card. A student loan has much lower interest, and the payment is usually deferred until after you graduate. In contrast, if you put the tuition on your credit card, you'll have to start paying it off in the first month you receive the bill. Be aware that if you start to rack up high balances by doing this, the credit bureaus may start to notice and those high balances could negatively impact your credit score if it starts to show up on your credit report.

9. Business Startup Expenses

It takes several years for a business to become profitable. So, putting your business expenses on the card is a big gamble. It is crucial to distinguish between personal and business expenses to avoid high-interest debt and poor financial management. You’ll be financing your business by paying high interest rates. Instead, consider a lower interest rate business loan. Also, often times before your business even gets going, you'll have high a annual percentage rate on your credit card, making this idea even less appealing.

10. Peer-to-Peer Payments

Popular platforms like Venmo allow you to connect your credit card. You can then use it to send money to businesses and people. But you’ll be charged a three percent transaction amount. And you risk the credit card issuer treating the transaction as a cash advance. You’ll be charged extra fees for this. Link your account to your debit card instead.

Conclusion

There's always the temptation to use a credit card for an expense, but doing this is always an expensive proposition. If you can't use your debit card or get a low-interest loan, you might want to forget about the purchase.