- Quick Summary

- Homes

- Private School

- Streaming Services

- New Cars

- Quality Healthcare

- Organic Food

- Entertainment

- Home Renovations

- Comprehensive Auto Insurance

- Childcare

- Emergency Expenses

- College Tuition

- Extended Family Vacations

- Retirement

- High-Speed Internet

- Specialized Medical Treatment

- Eco-Friendly Home Upgrades

- New Technology

- Luxury Splurges

- Conclusion

- Quick Summary

- Homes

- Private School

- Streaming Services

- New Cars

- Quality Healthcare

- Organic Food

- Entertainment

- Home Renovations

- Comprehensive Auto Insurance

- Childcare

- Emergency Expenses

- College Tuition

- Extended Family Vacations

- Retirement

- High-Speed Internet

- Specialized Medical Treatment

- Eco-Friendly Home Upgrades

- New Technology

- Luxury Splurges

- Conclusion

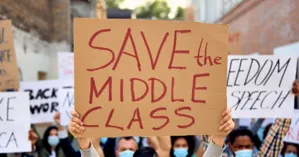

Every year, the middle class loses a little more buying power. Rising costs in education and healthcare, including soaring tuition fees and healthcare insurance premiums, mean a hundred dollars just doesn’t go as far as it used to. One bag of groceries is all you get when it used to be two bags for the same amount of money. What else is slipping away? Here are 19 things middle-class Americans won’t be able to afford in five years.

1. Homes

Home prices are rising, and with high interest rates and changes to property tax laws, it's becoming increasingly more difficult for anyone to buy a house and to be able to afford the size of house some families need. Middle-class households will be pushed out of home ownership and may be forced to rent or to look at multi-family units in the future.

2. Private School

Although many middle-class families are drawn toward private schools, the cost is becoming prohibitive. Currently, the price of a private high school is $16,000, but it will increase and become out of middle-class reach in the next five years. There is a growing need for substantial financial aid to make private schooling affordable.

3. Streaming Services

Americans spend an average of $60 monthly on streaming services. That cost will become inflated in the next five years, and it will be out of the reach of most middle-class families.

4. New Cars

With today's high-tech cars come high prices, and that's not going to end. Middle-class families won't be able to go into a dealership and buy a new car. They'll be relegated to always buying used.

5. Quality Healthcare

Healthcare costs have been outpacing general inflation rates for years. Insurance plans are available for most people, but affordable healthcare coverage remains a significant challenge. However, high deductibles and co-pays are making it difficult for middle-class Americans to get the healthcare services they need. In five years, they won’t be able to afford it. Rising healthcare costs are placing an increasing financial burden on middle-class families, making comprehensive healthcare coverage and access to medical services increasingly unaffordable.

6. Organic Food

Many people want to eat healthy, but they may not be able to afford it in the future. In general, food costs have risen. Produce increased ten percent in 2023, but organic produce increased by 13 percent during the same period.

7. Entertainment

Event ticket prices are on the rise. Since 2019, ticket prices for events have increased 14 percent. That includes movies, shows and sporting events. Tickets to your favorite team or Broadway show will be out of reach for the middle-class in the next five years.

8. Home Renovations

If you're lucky enough to buy a house, it will probably be a fixer-upper, which means home renovations. Between rising labor costs and supply shortages, the cost of renovating a house will be prohibitive, so you might be stuck with that old house for a long time.

9. Comprehensive Auto Insurance

In 2024, car insurance increased 26 percent, and that's not going to stop. Middle-class drivers may opt for less coverage and only buy state-mandated liability insurance. That means if a car is damaged or totaled, it could cause a family a financial catastrophe.

10. Childcare

Childcare options have been on the decline due to staff to child ratios since COVID. Child care workers are hard to find and good ones are hard to keep around the past few years. Combine that with higher prices, and childcare may be out of reach for many middle-class families. They may have to go back to a single income, which will press down on them financially even more.

Additionally, the rising costs of early childhood education programs contribute significantly to the overall expense of child care.

11. Emergency Expenses

With expenses going up, a middle-class family's emergency fund may be non-existent. There's just not enough to put away for a rainy day. This puts families even more on the economic precipice.

12. College Tuition

College may soon be reserved for the rich. Tuition has been steadily rising over the last twenty years, and combined with inflation, middle-class Americans may not be able to afford to send their children to college. The need for substantial financial aid is crucial to make college affordable for these families. According to the Pew Research Center, the rising cost of college education is making it increasingly difficult for middle-class families to manage without significant financial support.

13. Extended Family Vacations

Gone are the days of trekking across the country or going overseas. Instead, middle-class families will have to make do with staycations or weekends in neighboring towns.

14. Retirement

Saving for retirement will not be a possibility for many in the middle-class. They won't have the money to cover medical, housing and care expenses. Instead, they'll have to work longer or start a new job after they retire from their old one.

15. High-Speed Internet

The Internet is vital for participating in this high-tech world. But the middle class will find the price of high-speed internet too high, so they may have to opt for slower speeds.

16. Specialized Medical Treatment

Medical science is advancing, but that may not help the middle-class. Specialized treatments for diseases like cancer may become unaffordable. Health coverage and insurance premiums have already started to increase for the middle class, and also restrictions or specific requirements have increased meaning it's harder to access some special medical treatments. Insurance may not cover the cost and there may not be room in the budget for the out-of-pocket expenses.

17. Eco-Friendly Home Upgrades

Eco-friendly home upgrades are the rage, but the middle-class won't be able to afford insulated windows and solar panels. This could hamper widespread adoption of green improvements.

18. New Technology

The latest tech comes with a high price tag. The middle-class is already keeping their smartphones and tablets longer. This will continue in the future as rising costs in other sectors continue to grow so other areas, such as new technology, housekeeping services, and vacations will not have nearly as much budget put towards them. Having the latest will no longer be attainable.

19. Luxury Splurges

There won't be any money left over after paying all the bills for a splurge on something fun. Gone are those shopping days with friends. And that new tool you want is now out of reach. You'll need to be strict about your spending.

Conclusion

Purchasing power for the middle-class is slowly disappearing, especially for many middle class families. Middle class income is not keeping up with rising costs, making it harder for families to maintain their standard of living. A little piece of the American dream goes with the impending disappearance of home ownership and other niceties. This erosion of purchasing power significantly impacts the middle class lifestyle, as defined by the Pew Research Center, leading to a decline in the quality of life for many.