In 2022, inflation hit an all-time high of eight percent. When inflation happens the money that a retiree has saved is worth less. It can’t buy as many goods and services. But there are ways to lessen the impact of inflation on your retirement. Here are six strategies to protect your retirement. Additionally, planning for future inflation is crucial to ensure that your retirement savings can withstand long-term economic changes.

Understanding Inflation’s Impact on Retirement Savings

Inflation can have a significant impact on retirement savings, eroding the purchasing power of your money over time. The Federal Reserve aims to keep the inflation rate around 2%, but actual inflation rates can vary. When planning for retirement, it’s essential to consider how inflation affects your savings. A common default inflation rate for retirement planning is 2% annually, but real-world inflation can be higher. To safeguard your retirement savings, consider inflation-adjusted investments like Treasury Inflation-Protected Securities (TIPS) or real estate investment trusts (REITs). These investments can help maintain your purchasing power by adjusting for inflation.

Sources of Retirement Income

Retirees typically draw from multiple sources of income, including Social Security benefits, pensions, investment income, and sometimes part-time work. Each of these income sources has a different level of vulnerability to inflation. For instance, Social Security benefits are adjusted annually for inflation, providing some protection against rising prices. However, pensions may not always keep pace with inflation, potentially reducing their real value over time. Investment income, such as interest and dividends, can also be impacted by inflation, affecting your overall retirement income. Understanding the sensitivity of each income source to inflation is crucial for creating a sustainable retirement plan.

Social Security Benefits and Inflation

Social Security benefits are a cornerstone of retirement income for many Americans. While these benefits are adjusted annually for inflation through the cost-of-living adjustment (COLA), the adjustments may not always keep up with rising prices. For example, in 2022, the COLA was 2.5%, but the actual inflation rate was higher. Historically, the COLA has often been seen as inadequate, with estimates suggesting that Social Security benefits lost one-third of their purchasing power between 2000 and 2021. When planning for retirement, it’s essential to consider the potential impact of inflation on your Social Security benefits and explore additional income sources to cover any shortfalls.

Investment Income and Inflation

Investment income, such as interest and dividends, can be significantly affected by inflation. When inflation rises, interest rates may also increase, potentially leading to higher returns on savings accounts and bonds. However, inflation can erode the purchasing power of your investment income, making it essential to adopt strategies that mitigate this impact. Consider investing in assets that historically perform well during periods of rising inflation, such as real estate or commodities. Additionally, consulting a financial advisor can help you determine the right investment strategy for your retirement goals and risk tolerance, ensuring your investment income remains robust despite inflation.

Managing Inflation Risk in Retirement

Managing inflation risk in retirement requires a comprehensive approach. Here are some strategies to help mitigate the impact of inflation on your retirement savings:

- Invest in inflation-adjusted assets, such as TIPS or REITs, to protect your purchasing power.

- Diversify your investment portfolio to reduce exposure to inflation and spread risk.

- Consult a financial advisor to tailor an investment strategy that aligns with your retirement goals and risk tolerance.

- Regularly review and adjust your retirement plan to account for changes in inflation and market conditions.

- Consider investing in assets that have historically performed well during periods of rising inflation, such as real estate or commodities.

By understanding the impact of inflation on your retirement savings and taking proactive steps to manage inflation risk, you can help ensure a sustainable and secure retirement.

1. Don’t Hold Too Much Cash

Although you need some cash on hand for emergencies and day-to-day expenses, for the long-term you don’t want to keep excessive cash around. This is especially true when the economy is experiencing high inflation. The Federal Reserve System aims to keep the inflation rate around 2%, but actual inflation rates can vary. Inflation will eat the value of your cash away. Instead, consider investing it. Long-term investments will usually maintain your purchasing power. Additionally, consider how inflation adjustments, such as those applied to Social Security benefits, can impact your overall retirement income. Only hold two to three months of expenses in an emergency fund. The rest should be invested to grow.

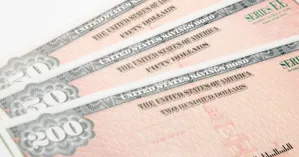

2. Get Inflation-Protected Bonds

You don’t want to take chances with your nest egg when you’re close to retirement. Retirees typically draw from multiple sources of income, including social security income, pensions, investment income, and sometimes part-time work. Combine that inflation, and you need a safe investment. That’s when it makes sense to protect your investment with inflation-protected bonds, such as Treasury Inflation-Protected Securities (TIPS). To mitigate this risk, consider investment strategies that offer inflation protection, such as inflation-linked securities or real asset allocations. TIPS protects your money by adjusting the principal amount with inflation or deflation as measured by the Consumer Price Index (CPI). TIPS tend to outperform against inflation.

3. Be Conservative When You Withdraw

Be conservative when withdrawing your savings; it will make it last longer. One approach is the four percent rule. That’s when you don’t withdraw more than four percent in any one year. While these benefits are adjusted annually for inflation through the cost-of-living adjustment (COLA), these inflation adjustments may not always keep up with rising prices. Many experts say that’s not even conservative enough. Basically, only withdraw what you truly need.

4. Invest in Commodities

Commodities do well when inflation gets bad. When inflation rises, interest rates may also increase, which can lead to a decrease in bond prices, affecting the returns on bond funds. They stay the same regardless of who made them or where they were produced. For example, oil, wheat, and corn are commodities that always remain the same. When inflation rises, interest rates may also increase, potentially leading to higher returns on savings accounts and bonds.

5. Stick With Your Investment Plan

Over long periods, investment returns in the stock market have outpaced inflation. If you’ve been invested in the stock market for the past few years, you’re probably ahead of inflation. Even if the stock market gets volatile, stay the course. Instead of abandoning the stock market, turn to Social Security (if you’re old enough) or any other income. This might be a good time to take on a side gig.

-

Consider investment strategies that offer inflation protection, such as inflation-linked securities or real asset allocations.

6. Buy a Growing Annuity

A growing annuity provides payments that increase over time, either monthly or annually. It's also called an increasing annuity or an escalating annuity. Annuities tend to outperform inflation.

Conclusion

It's imperative to protect your nest egg. This is especially true when you're close to retirement. Consider inflation-proof items like TIPS and commodities, and don't be afraid to stay the course.