An extra $1,000 a month can go a long way in paying off credit cards, saving or just having fun. But you might not have the time for a part-time job. We’ve got you covered. Here are 14 simple methods to earn passive income and explore various passive income ideas to generate $1,000 monthly.

1. Create an Online Course

Creating an online course requires a little upfront effort, but once the work is done, you can sit back and reap the benefits. You can offer courses on flipping real estate, personal finance, entrepreneurship, computer languages, woodworking, etc. Whatever you have expertise or unique knowledge about, many people will want. Once created, online courses can be sold multiple times, which is passive income. Sell your courses through social media or platforms like SkillShare, Udemy or teach:able. Creating an affiliate program can help drive referral traffic and increase revenue for your online course.

2. Sell Printables

Printables are digital products that can be purchased and printed online. The buyer will than print them in their home or uses them online. Some printables could be patterns, worksheets, templates, journals etc. You can sell them on your own website, Etsy, Shopify, social media (TikTok store), etc.

3. Affiliate Marketing

Affiliate marketing is when you recommend a product or service to an audience. A person can click through a link you provide to the retailer that sells what you promote. You receive a portion of the sales if they buy the product or service. This is a great way to generate passive income. There's no cost to join an affiliate marketing program, so there are no start-up costs. Promote the products on social media and when people buy, you make the money. Some affiliate programs that are available include ClickBank, Amazon, Etsy and ShareASale. Research which ones pay the most commission and have products that you feel comfortable promoting.

4. Online Stock Photos

If you like to take pictures or shoot videos, put those images to work for you. You can upload your pictures to photo sites that sell them to other people. When your photo or video is purchased, you receive a commission. The same image has the potential to be bought multiple times, so you have a passive income. Some platforms where you can upload include Adobe Stock and iStock.

5. Host a Dog Park

You'll need a fenced-in yard for this one. Whether it's for the locals or tourists, your land can earn money. Sniffspot is like Airbnb for dogs. And you don’t even have to meet the guest pooch owners. But you control the calendar. It’s not like they can just show up.

6. REITs

You can use a real estate investment trust (REIT) to earn money in real estate without buying property. An REIT is a company that owns and manages profitable real estate. An REIT lets small investors pool their money to afford investments they normally would be able to afford. For a long-term investment, REITs are great. Popular REITs are Crown Castle Inc. and Realty Income Corp. But be warned: With any investment, there’s always a risk, and the same holds true with REITs. Exchange traded funds are another viable option for generating passive income.

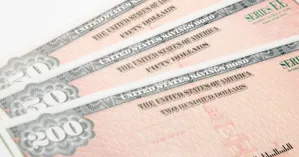

7. Series I Bonds

Due to rising interest rates, Series I Bonds have turned into a viable income investment. Series I Bonds provide regular interest payments, contributing to a steady stream of passive income. You can purchase these bonds with a 4.28 percent APY through October 2024. The rate will change at that time. The rate is tied to inflation, so the bond interest rate is low when inflation is low. When inflation is high, the bond interest rate is high. The Series I Bonds earn interest for 30 years. You can sell them after one year, but you’ll lose the last three months of interest. If you wait until five years, you’ll receive the total interest for the entire duration.

8. Crowdfunding

Using platforms like Fundrise or RealtyMogul discover and invest in commercial real estate. When you sign up for the service you gain access to a portfolio of real estate options where you can invest. With crowdfunding platforms, you can get access to REITs that produce ongoing income. You’ll receive quarterly or monthly dividends depending on what platforms you sign up for. Remember, investments hold risks, and crowdfunding is no different. Do the research and invest with caution. Another investment strategy to consider is peer-to-peer lending, which allows individuals to lend money directly to others and earn interest.

9. Rent Out Your Car

If you have an extra car you’re not using or work remotely and don’t use your car often, consider renting it to others. Some sites like Turo match those who need a vehicle to owners. You set the terms and make money when the car would normally not be driven. Turo handles all the paperwork and administration and vets the renters. They also provide $750,000 liability insurance. It’s your responsibility to keep the vehicle in good condition.

10. CDs

Certificates of deposits (CD) are deposits to banks or credit unions for set terms and earned interest. The interest is fixed and can be as high as five percent. If you don’t want to tie all your funds up in long-term CDs you create a CD ladder. Split your deposit between multiple CD terms. You could have a one, two and five-year CD. When one matures withdraw it or reinvest. They'll all be maturing at different times, so you'll have the money and earn great interest.

11. Open a High-Yield Savings Account

Take advantage of online banks and open a high-yield savings account. Most of these banks offer five percent APY, which is higher than the one percent or less of traditional banks. The initial investment required to set up a CD ladder can be relatively low, allowing you to start earning passive income over time. Park your money in one and let it work for you.

12. Develop an App

This has some upfront investment but ultimately turns into some great passive income. Your app should have users accomplish some hard-to-do functions. It could be a personal finance app, a dieting app, a shopping app or whatever your imagination comes up with. If your app becomes popular, you'll need to add additional features to keep it relevant. The risk is that you could invest your time and money without gain. If you are going into a crowded market, ensure you're offering something innovative. If you collect information, you must also comply with privacy laws. These are different for every country.

13. Invest in Dividend-Yielding Stocks

If you have some extra money, invest in dividend-yielding stocks. You’ll receive payment at regular intervals. Companies usually pay cash on a quarterly basis out of their profits. They’re paid per share, so the more shares you own, the more you’ll receive.

14. Purchase Domains to Flip

The stock market offers a lucrative potential for generating passive income through dividend-yielding stocks. Domain flipping is just like it sounds. You buy domains and flip them to higher bidders. Ensure you buy domains that are trending upward. Look at Google Trends to see what’s popular and buy through a hosting company. Then, put it on a site to sell. Sites where you can sell domains include sedo, SnapNames and NamePros.

Conclusion

We’ve offered you a variety of ways to generate $1,000 a month in passive income. Some require a little work at the start, but all will get you to your goal of ongoing passive income.