Sometimes it’s just hard to save. There’s always something that comes up that needs money. And let’s face it, sometimes you just forget to put some money away. There are ways to help you save. One of them is a savings app. Here are the best money saving apps for automating savings.

Money saving apps can help you track spending, establish savings goals, and automate the savings process. With a variety of options available, finding the best money saving app that aligns with your personal financial goals is crucial. These tools make financial management more accessible and tailored to various lifestyles.

Introduction

Saving money can often feel like an uphill battle. Unexpected expenses pop up, and sometimes, we simply forget to set aside funds. Fortunately, technology has come to the rescue with automatic savings apps. These digital tools make it easier than ever to save money without even thinking about it. By automating the savings process, these apps help you build a financial cushion, achieve your savings goals, and ensure you’re prepared for any financial surprises.

What are Automatic Savings Apps?

Automatic savings apps are digital tools designed to help individuals save money effortlessly by automating the savings process. These apps use various techniques, such as rounding up purchases to the nearest dollar, setting aside a fixed amount regularly, or using artificial intelligence to analyze spending habits and transfer excess funds to a savings account. By leveraging technology, automatic savings apps make it easier for people to develop a savings habit, build an emergency fund, and achieve their long-term financial goals.

The Importance of Saving Money

Saving money is a crucial aspect of personal finance that offers numerous benefits. It provides a safety net for unexpected expenses, helps individuals achieve their financial goals, and reduces stress and anxiety related to money management. Moreover, saving money can lead to long-term wealth creation, improved credit scores, and increased financial independence. By prioritizing saving, individuals can take control of their financial lives and make progress towards a more secure and prosperous future.

How to Choose the Best Automatic Savings App

With numerous automatic savings apps available, selecting the best one can be overwhelming. To make an informed decision, consider the following factors:

- Fees and charges: Look for apps with minimal or no fees, especially if you’re just starting to save.

- Savings goals: Choose an app that aligns with your specific savings goals, such as building an emergency fund, saving for a down payment, or investing in a retirement account.

- Automation features: Consider apps that offer flexible automation options, such as rounding up purchases, setting aside a fixed amount regularly, or using AI-driven savings algorithms.

- Security and reliability: Ensure the app is secure, reliable, and partners with reputable banks or financial institutions to protect your savings.

- User interface and experience: Opt for an app with a user-friendly interface that makes it easy to track your savings progress, set goals, and adjust settings as needed.

- Customer support: Look for apps with responsive customer support, in case you need assistance or have questions about the service.

- Reviews and ratings: Research the app’s reputation by reading reviews from other users and checking its overall rating on app stores or review websites.

By considering these factors, you can find the best automatic savings app that suits your needs and helps you achieve your financial goals.

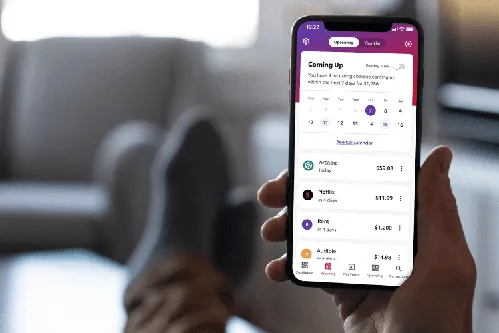

1. Rocket Money: Automatic Savings App

There are several reasons to use Rocket Money, a money saving app. It has many money-saving and budgeting features. Link your bank and investment to automate your savings. You’ll receive balance alerts, track spending and manage subscriptions. There are graphs that show your spending history, credit score and net worth. Rocket Money has a free version and premium versions for three to $12 a month.

2. Current: All-Mobile Banking App

Current offers a deposit account that combines savings and checking account features. This includes a debit card and the ability to earn interest on your money through a high yield savings account. You can set up savings goals called “pods”. The pods can automatically sweep money aside to meet your goals. To use Current you must have Current’s free deposit account.

3. Acorns: Savings Account

Acorns is one of the line money saving apps that puts your change into an investment account. Link your debit or credit card and Acorns rounds up your purchases to the next dollar. That allows you to invest spare change into a diversified investment portfolio. It’s great for novice investors and costs three dollars a month.

4. Chime: Auto-Savings App

Chime offers bank accounts that include several auto-savings features. Set it up as a direct deposit and Chime will move a percentage of your paycheck into your savings account. It also has a round-up option from your purchases that will boost your savings. And best of all, it's free.

5. Qapital: Savings Goals

Qapital is one of the money saving apps that will also save money for you on your terms. It has you set up so-called savings rules. For example, you could set up guilty pleasure rules. If take-out is a guilty pleasure then Qapital will put money away for you every time you get it. You can link your checking account or use a Qapital Spending account. The spending account comes with a debit card. You can also open an investment account. The basic plan is three dollars monthly. A 30-day free trial is available.

6. Oportun: Money Savings App

Oportun, considered by many as the best money saving app, analyzes what goes in and what goes out of your checking account. It saves for you by periodically moving funds from checking to savings. It’s based on what Oportun’s algorithms believe is safe for you to save. If it doesn’t determine you can spare the funds, it won’t withdraw it. This is great for the big spenders who want to ensure you save.

Conclusion

If you need to save but somehow never get around to it, an automatic savings app might be for you. There are several of the best money saving apps available that make it easy for you to start an emergency fund.