- Quick Summary

- Set Financial Goals

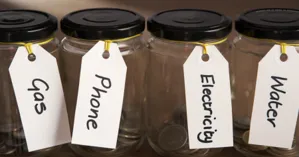

- Create a Budget

- Automate Saving Money for an Emergency Fund

- Start a Side Hustle

- Save on Groceries to Increase Savings

- Saving on Gas Helps Savings

- Save Money on Electricity

- Invest in Energy-Efficient Light Bulbs

- Use Appliances During Off-Peak Hours

- Shop or Sell at Thrift or Consignment Stores

- Buy Household Supplies When On Sale

- Use a High-Yield Bank Accounts for Retirement Savings

- Cancel Excessive Subscriptions

- Cut Cell Phone Expenses

- Use the 30-Day Rule with Purchases

- Don’t Save Billing Information

- Plan Major Purchases

- Downsize Your Housing

- Buy A Car at End of the Quarter

- Saving Helps Financial Literacy

- Conclusion

- Quick Summary

- Set Financial Goals

- Create a Budget

- Automate Saving Money for an Emergency Fund

- Start a Side Hustle

- Save on Groceries to Increase Savings

- Saving on Gas Helps Savings

- Save Money on Electricity

- Invest in Energy-Efficient Light Bulbs

- Use Appliances During Off-Peak Hours

- Shop or Sell at Thrift or Consignment Stores

- Buy Household Supplies When On Sale

- Use a High-Yield Bank Accounts for Retirement Savings

- Cancel Excessive Subscriptions

- Cut Cell Phone Expenses

- Use the 30-Day Rule with Purchases

- Don’t Save Billing Information

- Plan Major Purchases

- Downsize Your Housing

- Buy A Car at End of the Quarter

- Saving Helps Financial Literacy

- Conclusion

With the economy, food and other essentials comprise a significant portion of your monthly income. But you can still save. There are numerous ways to put away cash without missing out on life. In fact, by saving, you’ll enhance your life. Here’s an expert’s guide to maximizing your savings in 2024.

Set Financial Goals

It’s hard to save if you don’t have financial goals. Setting clear financial goals is crucial as it helps you stay motivated and effectively manage your personal finances. You’ll be more motivated if you write down a goal and think about it every time you put money away. It could be for an emergency fund, a house or a wedding. But ensure you have a reason to save money.

Create a Budget

You won’t know how to reach that goal if you don’t know what you’re starting with. Financial literacy is crucial in budgeting as it helps you understand and manage your finances effectively. Write down all your expenses, including your coffee habit or those after-work drinks. Use the 50-30-20 rule.

-

50% toward needs

-

30% goes toward wants

-

20% goes into a savings account

If you see you’re spending too much to save, use budgeting apps or a spreadsheet to determine where your money is going. Then look for places you can cut back.

Remember, you have savings goals to reach.

Automate Saving Money for an Emergency Fund

This goes to the philosophy of paying yourself first. Set up an automatic deposit into a high-yield savings account or money market. That way, you’ll pay yourself first. Ensure you put that 20 percent away before you spend money on anything else.

Pay Down Debt

Concentrate on paying down your high-interest debt, especially credit card debt. This will free up more money for savings. Use the snowball method.

The snowball method involves making extra payments to the smallest debt first while still paying your other debt. Once the small debt is paid off, you put the payments you were making toward that into paying the larger debt, and so on.

Start a Side Hustle

There are many small businesses you could start. From freelance writing to starting a YouTube channel, start bringing in extra money.

Starting a side hustle can be a significant step towards achieving financial independence, especially for millennials who are focused on improving their financial habits and planning for a secure future.

Save on Groceries to Increase Savings

In 2023, Americans spent 11.2 percent of their disposable income on food. It’s a big chunk of your take home pay. So, cutting food costs can put more money in your pocket. But you must eat, so how do you cut costs?

By saving on groceries, you can better manage your living expenses and build an emergency fund to cover unexpected costs.

Prep Meals at Home

Prep your meals for the week on Saturday or Sunday. It will save you time during the week and will help you avoid eating out or getting takeout every night.

By buying your food from a restaurant, you drive up your food costs. Plus, you don't eat as healthy as you would eating at home. You can cook lower-fat meals that are higher in protein. Vegetables are more likely to end up on your plate than at a fast-food restaurant.

Make a Shopping List

It seems simple, but if you make that list and stick to it, you’ll save money. Don’t be tempted by the display at the end of the aisle. Only go to the areas in the store where you need the items on your list.

By doing this, you'll save on food costs and calories. You won't buy that package of cookies or chips if they're not on the list.

Shop in the Middle of the Week

Stores run sales midweek. The heavy shopping days are on the weekends, so stores try to attract customers during their off times—experiment by going to the grocery store at different times and days. You'll get to know the sales cycle.

Stay on the Grocery Stores’s Perimeter

Avoid going into the middle of the store where all the temptation lies. Unless you absolutely need something on your list, stay on the perimeter.

Always look at the top or bottom shelves to find deals when shopping. Grocery stores know that you’ll usually just look straight at eye level and pick up what you see.

The more expensive items will be at eye level.

Buy Generic

You’ll usually find the store brand or other generic brands much less expensive than the name brand. And these generic brands are usually just as tasty and nutritious.

Saving on Gas Helps Savings

Although it varies according to your driving frequency, most Americans spend between 2.4 and five percent of their monthly income on gas. But there are tricks to cutting down on your gas usage.

Drive and Brake Slower

Driving fast wastes gas. You can expect to lose one to two percent of fuel economy for every mile per hour (mph) driven over 55. That means that a car that gets 25 miles per gallon (mpg) at 55 mph might only get 19.3 mpg at 75 mph.

If you’re going faster than 75 mph, you lose even more.

Braking wastes gas and lowers fuel economy. It can result in a ten to 40 percent decrease in stop-and-go traffic and a 15 to 30 percent loss on highways. If you slam on your breaks and then go, you're wasting even more gas.

Maintain Your Vehicle

Keeping your vehicle maintained will optimize your fuel usage. Ensure you have frequent tune-ups and regular oil changes. These will make your vehicle fuel-efficient. It will also keep it out of the shop for something major.

Gas Comparison Apps

Using a gas comparison app like GasBuddy will help you find the cheapest gas in your area. This is also true if you go on vacation. You can use apps to calculate trip costs to work gas into your budget.

Carpooling with Co-Workers or Friends

Split the cost of fuel by taking turns driving with friends or co-workers. Besides saving gas, you'll have access to carpool lanes, which will help you avoid traffic. That saves gas, too.

Save Money on Electricity

With energy rates continuing to rise, saving money on electricity is imperative. But there are ways to help lower your energy bill.

Eliminate Vampires

Even if you’re not using the device, if it’s plugged in, it’s still drawing electricity. This is called an electric vampire. Go through your house and unplug everything that’s not being used. This could include the

-

Television

-

Laptop

-

Desktop computer

-

Iron

-

Microwave (if you can)

-

Phone charger

-

Etc.

It doesn’t seem like a big thing, but these are all items that are sucking you dry.

Invest in Energy-Efficient Light Bulbs

LED bulbs use about 70 percent less energy than regular incandescent bulbs. They also last up to 25 times longer. You'll save money on energy bills and replacement bulbs. Install dimmer switches with your LED bulbs to stretch your energy usage a little further.

Use Appliances During Off-Peak Hours

The demand for electricity is usually highest between 3 p.m. and 7 p.m., and electric companies charge the highest rate during this time. Since washers, dryers, and dishwashers use a lot of electricity, do your washing after seven.

Or, if you're an early bird, do a load of laundry or run the dishwasher in the morning.

Ceiling Fans Circulate Air

Ceiling fans lower your energy bill while providing comfort. You'll feel cooler when it circulates the AC's cool air in the summer. You'll also feel warmer in the winter from the furnace. The result is you can adjust your thermostat up or down without burning up or freezing.

Check House for Leaks

Check doors, vents and windows. Is there any air coming leaking into the house from outside? You could be paying for electricity, that’s heating or cooling the outside. Get out that caulking gun and seal any cracks.

Shop or Sell at Thrift or Consignment Stores

Both thrift and consignment stores offer deals on used clothes. The consignment stores will probably have more gently used, but you could find some gems at the thrift shop.

Thrift stores often have craft items for sale. If you’re just taking up a hobby, check the thrift store out, before spending too much money. You might find everything you need.

The same goes for selling your used items. Take your items to consignment shops. They’re easier than an app and you won’t have to mess with shipping.

Buy Household Supplies When On Sale

Dishwashing soap, paper towels or toiletries are always needed. Look for sales on these items and then stock up on them. If you have them on hand, you won't be rushing at the last minute to buy them. If you were desperate enough for that toothpaste, you may spend more than you would have.

Use a High-Yield Bank Accounts for Retirement Savings

Check out online banks. They usually offer high-yield accounts like:

-

Checking

-

Savings

-

Money Market

Many of them pay up to five percent interest. That’s a lot more than traditional banks who sometimes pay less than one percent interest.

Although online bank accounts are accessible, since it’s not part of your regular banking, you may not be as apt to withdraw from it.

Using high-yield bank accounts can also be a strategic way to boost your retirement savings early, taking advantage of compound interest for a secure financial future.

Cancel Excessive Subscriptions

You probably have subscriptions to services you no longer use. Go through your credit card bill and identify the ongoing charges. Do you need them? Think how much you could put in your savings account if you eliminated some of these charges.

Be careful when signing up for free trials. You may end up paying for a service you don’t want because you forgot to cancel it.

Canceling unnecessary subscriptions can significantly contribute to your financial stability by allowing you to save more and allocate funds towards important financial goals.

Cut Cell Phone Expenses

Change your plan periodically to save money. Another way to save money on cell phones is to sign up for auto-pay or paperless statements. This could save you five to ten dollars monthly.

Check on that insurance. If you have an older phone, it may not be worth it. Depending on the phone and company, you could save $80 to $300 per month.

Reducing cell phone expenses can contribute to your overall financial security by freeing up funds that can be redirected towards building an emergency fund or maximizing employment benefits.

Use the 30-Day Rule with Purchases

Walk away from a purchase for 30 days. Consider this a cooling-off period. If you really want or need it, buy it after a month.

If you're shopping online, put it in your cart and then walk away. Leave it there. If you think 30 days is too long, consider 48 hours.

If the retailer sees you've abandoned the cart, they may send you a coupon. But don't let that sway you. Let yourself cool down.

Don’t Save Billing Information

Delete all your billing information from your favorite retailers. If you must hunt for your wallet or purse to make a purchase, you’ll probably have enough time to stop yourself from buying it.

This will keep you from impulse buying because you’ll have to go through the extra work of paying.

Plan Major Purchases

If you want or need to make a major purchase, wait for the annual or quarterly sales. Keep an eye on prices and track them over time.

There are tools to help. The Camelizer tracks Amazon and will alert you when there’s a price drop. You could also use the Honey browser extension. It pulls in coupon codes and monitors lower prices elsewhere.

While looking for the best price, put money away so you don’t have to use your credit card on the purchase. Planning major purchases carefully can also help you avoid accumulating student loan debt.

Downsize Your Housing

If you’re renting a three-bedroom house or apartment, do you really need it? If not, consider renting a smaller apartment. Take the savings and deposit them in your savings account.

Can you get a roommate? That will be half your expenses if you share the space with someone.

If you own a large home, consider downsizing. If economically it doesn't make sense because of interest rates (especially if you have a low one), consider renting a room or garage to someone.

Buy A Car at End of the Quarter

Buy your car at the end of:

-

March

-

June

-

September

-

December

Sales managers and salespeople are given quarterly goals. They want to meet those goals so they’re willing to cut prices at the end of the quarter. Goals are set monthly as well, but the biggest bonuses come at the quarter’s end. They’ll be ready to deal.

Saving Helps Financial Literacy

Whether starting a rainy day fund or saving for that big wedding, you’ll be better off financially if you put some money away to grow as part of your personal finance strategy.

Start by cutting expenses. Then, use what you’ve cut to start and feed a high-yield savings account. Saving diligently can be a crucial step towards achieving financial freedom.

Conclusion

Maximizing your savings in 2024 doesn’t have to mean making sacrifices or missing out on life’s pleasures. By following these expert tips—setting clear goals, creating a budget, automating your savings, and cutting costs in areas like groceries, gas, and electricity—you can take control of your finances. Start small with simple changes, like meal prepping and carpooling, and watch your savings grow. Whether you’re saving for a rainy day or working toward a larger financial goal, these strategies will help you build a more secure and prosperous future. Adopting these responsible financial habits is crucial for ensuring a stable and successful financial future.