- Quick Summary

- Keep Emergency Funds in a High-Yield Savings Account

- Keep Emergency Funds in a Traditional Savings Account

- Keep Emergency Funds in a Money Market Account

- Don’t Keep Emergency Funds in a CD

- Don’t Keep Emergency Funds in a Checking Account

- Don’t Keep Emergency Funds in the Stock Market

- Don’t Keep Emergency Funds in Savings Bonds

- Don’t Keep Emergency Funds at Your House

- Conclusion

- Quick Summary

- Keep Emergency Funds in a High-Yield Savings Account

- Keep Emergency Funds in a Traditional Savings Account

- Keep Emergency Funds in a Money Market Account

- Don’t Keep Emergency Funds in a CD

- Don’t Keep Emergency Funds in a Checking Account

- Don’t Keep Emergency Funds in the Stock Market

- Don’t Keep Emergency Funds in Savings Bonds

- Don’t Keep Emergency Funds at Your House

- Conclusion

You might want to sock some money away for emergencies. Keeping emergency savings in safe and accessible accounts, such as high-yield savings accounts, online savings accounts, and money market deposit accounts, is crucial. But not knowing the best or worst places to keep these emergency funds could hurt you if something goes wrong. We’ve compiled a list of the best and worst places to keep emergency funds.

1. Keep Emergency Funds in a High-Yield Savings Account

Online banks offer high-yield savings accounts, a type of bank account. They don’t have to worry about the cost of maintaining brick-and-mortar branches, and they pass that savings onto their customers by paying high interest. The nice thing about high-yield savings accounts is that although they’re accessible in an emergency, they aren’t too available for day-to-day spending. You’re less likely to spend it on frivolous items. There’s a psychological advantage to keeping your money in a savings account.

2. Keep Emergency Funds in a Traditional Savings Account

You may not have the high interest rate that comes from an online bank, but if you like your current bank or credit union, open a savings account. Only use that account for your emergency fund. Don’t connect it to your checking account. You’ll be tempted to dip into it.

3. Keep Emergency Funds in a Money Market Account

Money market accounts, offered by both banks and credit unions, are like a high-yield savings account. It offers higher interest than your local bank but provides accessibility like a checking account. You can write checks using it and you’ll have a debit card. But you might want to skip a money market account if you don’t have discipline.

4. Don’t Keep Emergency Funds in a CD

A certificate of deposit (CD) is an account that offers a fixed rate for a specific time. In exchange for the fixed rate, you agree not to take your money out of it before the time or term ends. The advantage is it grows your money, but it will not be accessible if you need it for an emergency, making it unsuitable for your entire emergency fund. Go with a high-yield savings account instead.

5. Don’t Keep Emergency Funds in a Checking Account

Never keep your emergency fund in a checking account; they are too accessible. It’s better to keep it away from money that you use for everyday expenses. The other negative is the lack of earning potential. There usually isn’t any interest; if there is, it’s nominal at best.

6. Don’t Keep Emergency Funds in the Stock Market

In order to achieve the ten percent or more growth the stock market affords, you have to be in it for the long haul. It’s not for those who want to take their money out immediately. It's crucial to have funds available for living expenses in case of emergencies. Sometimes, selling fast isn’t possible. Avoid the market; you’re better off sticking with savings accounts or money markets.

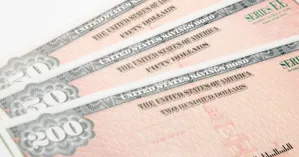

7. Don’t Keep Emergency Funds in Savings Bonds

Series I Bonds are considered a safe investment. The interest rate for the bond changes twice a year and it can either go up or down depending on inflation. But they are not a place to store an emergency fund. Your money is tied up for at least a year and if you withdraw funds before five years, you’ll lose the previous years’ interest. They are a terrible place to keep an emergency fund.

8. Don’t Keep Emergency Funds at Your House

Some people like to stash some money away in their homes. However, it is crucial to have accessible funds for unexpected expenses such as medical bills, home-appliance repairs, or major car fixes. But this can be a disaster if you’re robbed or have a fire. There goes your fund. Your money will not be working for you if you keep it at home. That’s because it won’t be earning the interest you’d have in a savings account.

Conclusion

Put your emergency funds where they can grow for you but still be somewhat accessible. It is important to keep these funds in accounts insured by the National Credit Union Administration, which provides federal insurance coverage for up to $250,000 per person, per account category. You want them if you have a major emergency, but you don’t want them in your checking account, where you can blow them on frivolous items.