- Quick Summary

- Avoid BNPLs

- Time Your Buying for Big Purchases to Save Money

- Unsubscribe from Store Emails

- Use a Coupon Browser Extension

- Treat Credit Cards Like Cold, Hard Cash

- Remember to H.A.L.T.

- Avoid Pre-Packaged Items

- Focus on Needs not Wants

- Plan Recipes Ahead of Time

- Seasonally Shop

- Take Inventory

- Watch the Price Per Unit and Compare Prices

- Pay Attention at the Register

- Always Negotiate Prices

- Conclusion

- Quick Summary

- Avoid BNPLs

- Time Your Buying for Big Purchases to Save Money

- Unsubscribe from Store Emails

- Use a Coupon Browser Extension

- Treat Credit Cards Like Cold, Hard Cash

- Remember to H.A.L.T.

- Avoid Pre-Packaged Items

- Focus on Needs not Wants

- Plan Recipes Ahead of Time

- Seasonally Shop

- Take Inventory

- Watch the Price Per Unit and Compare Prices

- Pay Attention at the Register

- Always Negotiate Prices

- Conclusion

In an inflationary economy, every cent counts. One way to save money is to win at the cash register. If you’re online, you want to know that when you hit that order button, you’ve saved some money. There are ways to spend less. Here is an expert’s take on 14 smart shopping techniques to save big, including how to compare prices effectively.

Avoid BNPLs

Ensure you don't fall for the "buy now pay later" offers. You pay in four installments and only have to pay a quarter of the cost upfront. But beware if you miscalculate your ability to pay it back in those installments. You'll pay up to 36.99 percent interest rates if you miss a payment. You'll also owe fees up to 25 percent of the original price. That's no deal.

Time Your Buying for Big Purchases to Save Money

If you want big items like furniture or appliances, wait for a holiday weekend. Retailers will offer sales on people’s days off to draw you into their stores. Shop at the end of the season for winter or summer items. For example, put off buying that patio furniture until late August. Additionally, take the time to compare prices across different retailers to maximize your savings.

Unsubscribe from Store Emails

You may have given the online retailer your email to score a discount, but unsubscribe when you start receiving them. Otherwise, you'll be receiving sales and other specials that will tempt you into making a purchase. And it's usually something you wouldn't have thought of but it "looks cute". Just take the temptation away and you'll save money.

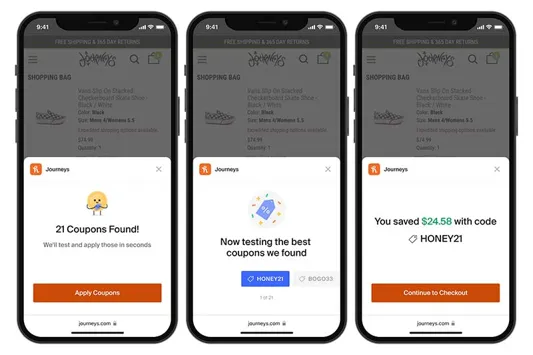

Use a Coupon Browser Extension

Yes, this one only gives you coupons for what you’re looking at. But if you’re on the fence about an item, this might push you over the edge. But remember, the more you buy, the more you save mentality often leads to overspending. Don’t let a coupon or discount convince you to spend money. Watch out for those “click-to-apply” coupons. These psychologically trigger a greater sense of reward. They entice you to buy more. Shopping apps can also help in finding and applying discounts, promo codes, and cashback offers, streamlining the saving process while facilitating price comparisons across various retailers.

Treat Credit Cards Like Cold, Hard Cash

Buying online with a credit card distances you from the purchase and makes you feel like you're not spending real money. To retrain your brain, check your credit card balance weekly. That way, it will remind you that you're actually spending cash.

Remember to H.A.L.T.

Never buy anything if you’re hungry, angry, lonely or tired (H.A.L.T.). Otherwise, you'll make impulse purchases that you might regret.

Avoid Pre-Packaged Items

When grocery shopping, avoid pre-packaged items. They look tempting, and you can’t beat the convenience, but they can break the bank. Cut your own fruit and vegetables and put them in containers. Buy in bulk and separate the produce into smaller containers. It may take a few extra minutes, but you’ll save a lot. Additionally, frequenting low-cost grocery stores and using store loyalty programs can help you maximize your savings.

Focus on Needs not Wants

Online retailers are selling items you don’t need. They make buying seamless and enjoyable with flashy sale banners and one-click-to-buy features. You must avoid these tricks. When shopping online, do what you do at the grocery store; have a list in hand. Put it on a sticky note on your computer and don’t deviate from it. And never go online when you’ve been imbibing alcohol. Cocktails and a credit card will lead you to bust your budget. Planning for your next shopping trip can help avoid impulsive purchases and stick to the list.

Plan Recipes Ahead of Time

Know what you’ll be cooking and eating for the week. Then buy it in one visit to the store. This is better than going to the store several times a week. The more often you’re in a store, the more temptation you face. It also keeps you from buying a product, thinking it would be good for a meal, and then arriving home to find that you need other items to go with it—one more trip to the store. If you had planned, you’d already have it. Planning for the next shopping trip can help avoid multiple trips to the store and reduce impulsive purchases.

Seasonally Shop

Buy fruits and vegetables that are in season. If you’re buying blueberries in the winter, you’re probably paying a lot more than you would when they’re in season. Consider frozen fruit if you really need those blueberries in your yogurt.

Take Inventory

Never go shopping before taking an inventory of what you have in the fridge and pantry. “Do we need milk”? This is a question that may happen if you haven’t looked before you left. So if you think you do buy it and then find you don’t need it, you’ve just wasted money and maybe the product if it spoils before it’s used. Once you take Inventory, make a list to accompany the recipes you’ve planned for the week. Taking inventory can also help in planning for the next shopping trip and avoid unnecessary purchases.

Watch the Price Per Unit and Compare Prices

Understand the price per unit. It’s a great way to find the best deals. If you look at the unit price listed on the tag below the item, you might find that the larger item really isn’t a deal. Or you may find that it is. But you won’t know if you don’t look. Taking a little extra time to compare prices per unit across different retailers can help you save money on your purchases.

Pay Attention at the Register

This is probably one of the most important tips. It applies whether at the grocery store or in a brick-and-mortar store buying clothes. Pay attention to the prices and make sure that’s what you’re receiving. Stores have numerous sales on thousands of items. Sometimes a sale price may not be in the system, and you won’t receive it if you don’t look. Then you’ve lost the deal. Taking a little extra time to compare prices before heading to the register can ensure you get the best deal.

Always Negotiate Prices

Some prices are set in stone, and you can’t negotiate them. But always ask. If the item has a blemish, can you get a better deal? Or, instead of a discounted price, can you get free delivery? Ask for a bundle price if a salesperson is trying to sell you extras that complement the main item. Many consumers leave money on the table because they just don’t ask. Negotiating prices can positively impact your bank account by saving money on purchases.

Conclusion

Be on the lookout for deals, but there are subtle ways you can save without a sale. Check those prices at the register and always negotiate. Also, ensure you're focusing on needs, not wants.