AI apps automate various financial tasks, improve decision-making and provide valuable insights. They utilize machine learning to help you budget, track expenses, and manage your investments through comprehensive financial tracking, which consolidates data from multiple sources to monitor overall financial health. Additionally, these personal finance tools enhance users' financial well-being by providing personalized guidance and real-time insights. Using all this information, they’re able to perform financial forecasting. We’ve compiled the best ones to try in 2024.

Introduction

The integration of Artificial Intelligence (AI) in personal finance has revolutionized the way we manage our money. AI-powered personal finance apps have made it easier for individuals to track their spending, create budgets, and set financial goals. These apps use machine learning algorithms to analyze financial data and provide personalized financial advice, helping users make informed decisions about their money. In this article, we will explore the top AI-powered personal finance apps for 2024 and discuss the safety and security of these apps.

Understanding AI in Personal Finance

AI in personal finance refers to the use of machine learning algorithms to analyze financial data and provide personalized financial advice. These algorithms can analyze large amounts of data, including spending habits, financial goals, and market trends, to provide users with a comprehensive financial overview. AI-powered personal finance apps can help users manage their financial accounts, track their cash flow, and make informed investment decisions. Additionally, these apps can provide users with personalized financial advice, helping them to achieve their financial goals.

Top Personal Finance Apps for 2024

Here are some of the most popular personal finance apps for 2024 - most of these you've already heard of, but as a reminder, they're leaders in the personal finance space and should also be rolling out AI features soon, if they haven't already.

Mint: Mint is a personal finance app that uses AI to track spending, create budgets, and set financial goals. It also provides users with a comprehensive financial overview, including cash flow and investment management.

Personal Capital: Personal Capital is a financial management app that uses AI to track and analyze user spending, investments, and debts. It also provides users with personalized financial advice and investment management.

Digit: Digit is an app that uses AI to automatically save small amounts of money from a user’s checking account. It also provides users with a comprehensive financial overview and personalized financial advice.

Wally: Wally is a financial management app that uses AI to track expenses, income, and savings goals. It also provides users with personalized financial advice and investment management.

YNAB (You Need a Budget): YNAB is a budgeting app that uses AI to help users manage their finances and stay on top of expenses. It also provides users with personalized financial advice and investment management.

Top AI-Powered Personal Finance Apps for 2024

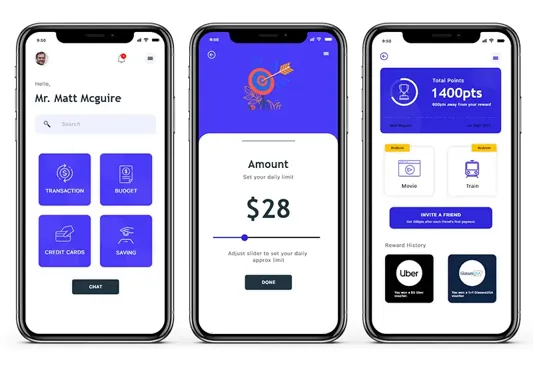

1)Qapital

Qapital provides goal-based savings, spending tracking and investment options. You’ll be able to set and achieve financial goals; it provides options to invest saved money to grow your wealth. It focuses on goal-based savings and investing, enhancing cybersecurity and operational efficiency for financial institutions through AI technologies. AI-powered apps also help users maintain and reconstruct their financial lives safely by adopting best practices like unique passwords and multi-factor authentication.

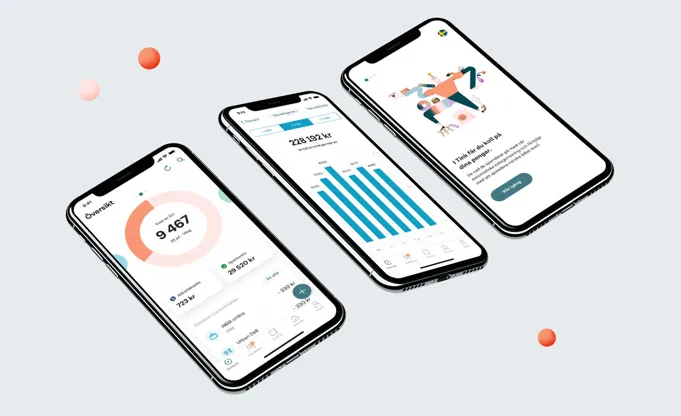

2)Tink

Tink provides finance management, account aggregation and budgeting tools. You’ll receive a clear finance overview. Tink is suitable for you if you want to consolidate your financial information.

3)MoneyLion

MoneyLion’s main features are credit monitoring, financial tracking and personalized loans. It monitors all your financial activities. It also keeps track of credit scores and gives you tips on how to improve them. If you want to manage finances and monitor your credit this one is for you.

4) PocketGuard: Comprehensive Financial Tracking

PocketGuard provides detailed budgeting tools that monitor spending and help people stay within budget. MoneyLion offers comprehensive financial tracking to monitor all financial activities, making it great for those who need budgeting and expense tracking.

5)Plum

Plum automates savings based on spending habits, provides investment options and helps you budget. It automatically sets a determined amount of money aside, so you don’t have to think about saving. You’ll also have the option to invest savings in various financial instruments. Wally, on the other hand, offers innovative personal finance tools that enhance users' financial well-being by serving as financial coaches on their phones.

6)Fyle

Fyle is designed for business expense management. It automates expense reporting by providing receipt scanning and integration with popular accounting software. PocketGuard helps users save money through effective budgeting tools, personalized savings tips, and automated savings functionalities. It streamlines the process of tracking and reporting expenses.

7)Emma

Emma manages and cancels subscriptions, tracks expenses in real-time, and provides budget insights. It allows you to stay within your financial limits. Emma works well if you want to monitor your spending and manage recurring payments. Plum connects to users' bank accounts to automate savings and provide investment options.

8)Cleo

Cleo offers personalized financial advice based on your spending and savings goals. It also provides you with budgeting tools. Cleo will work for you if you want to manage your finances.

9)Acorns

Acorns invests your spare change automatically. It rounds up purchases at select retailers and micro-invests the difference, helping users manage their personal finances by tracking expenses in real-time. This app is ideal for anyone starting out with little to invest.

Safety and Security of Personal Finance Apps

Personal finance apps use various security measures to protect user data and prevent financial fraud. These measures include:

- Encryption: Personal finance apps use encryption to protect user data, including financial information and login credentials.

- Two-Factor Authentication: Personal finance apps use two-factor authentication to verify user identities and prevent unauthorized access to user accounts.

- Secure Servers: Personal finance apps use secure servers to store user data, including financial information and login credentials.

- Regular Updates: Personal finance apps regularly update their software to ensure that users have the latest security features and patches.

Overall, AI-powered personal finance apps have made it easier for individuals to manage their finances and achieve their financial goals. These apps use machine learning algorithms to analyze financial data and provide personalized financial advice, helping users make informed decisions about their money. Additionally, these apps use various security measures to protect user data and prevent financial fraud.

Conclusion: Personal Finance Tools

These apps are made to organize your finances. Most of them have simple interfaces and are easy to use. Cleo, for instance, excels at providing personalized financial advice by offering tailored recommendations based on users' spending and savings goals. If you have challenges with budgeting or want to start investing, one of these apps will work for you.